25

CLIMATE ROUNDTABLE - TOWARDS A GREENER FUTURE

A low carbon transport system can, if managed wisely by

reducing demand and encouraging innovation, save the United

States, European Union countries, China, Japan, and India trillions.

The story for the transition away from oil is a bit more nuanced.

Our analysis shows that here, too, many nations stand to benefit,

if they manage the transition wisely. As net consumers of oil,

the United States, European Union countries, China, Japan,

and India could see huge financial benefits by transitioning to

a low-carbon economy. For them, transitioning away from oil

makes sense for reasons of self-interest and, even if they act

without net producers, they stand to benefit. Intriguingly, our

analysis also shows that if this group of countries chooses to

act, net producers would minimise their financial losses by also

reducing domestic demand for oil.

Policy should focus on reducing demand and driving innovation

to maximise the benefits and minimise the costs across net-

consuming and net-producing countries.

A key point for policymakers looking to maximise the benefits

of the transition is that policies matter. Our analysis shows

that a combination of demand reduction policies (such as

through reduced subsidies or increased taxes for fossil fuels)

and innovation provides the most promising policy approach.

Crucially, our analysis shows that restricting production without

addressing demand is an inefficient approach that creates

numerous costly distortions to the economy.

The takeaway from the analyses of the costs of transition,

both for the power and transport sectors, is clear. Countries

concerned about the financial health of their economies over

the coming decade and beyond should be looking hard at a

low-carbon transition in energy.

A shift to low-carbon power along with

reducing oil in transport could save the

global economy trillions over the next 15 years.

David Nelson,

Climate Policy Initiatve

0

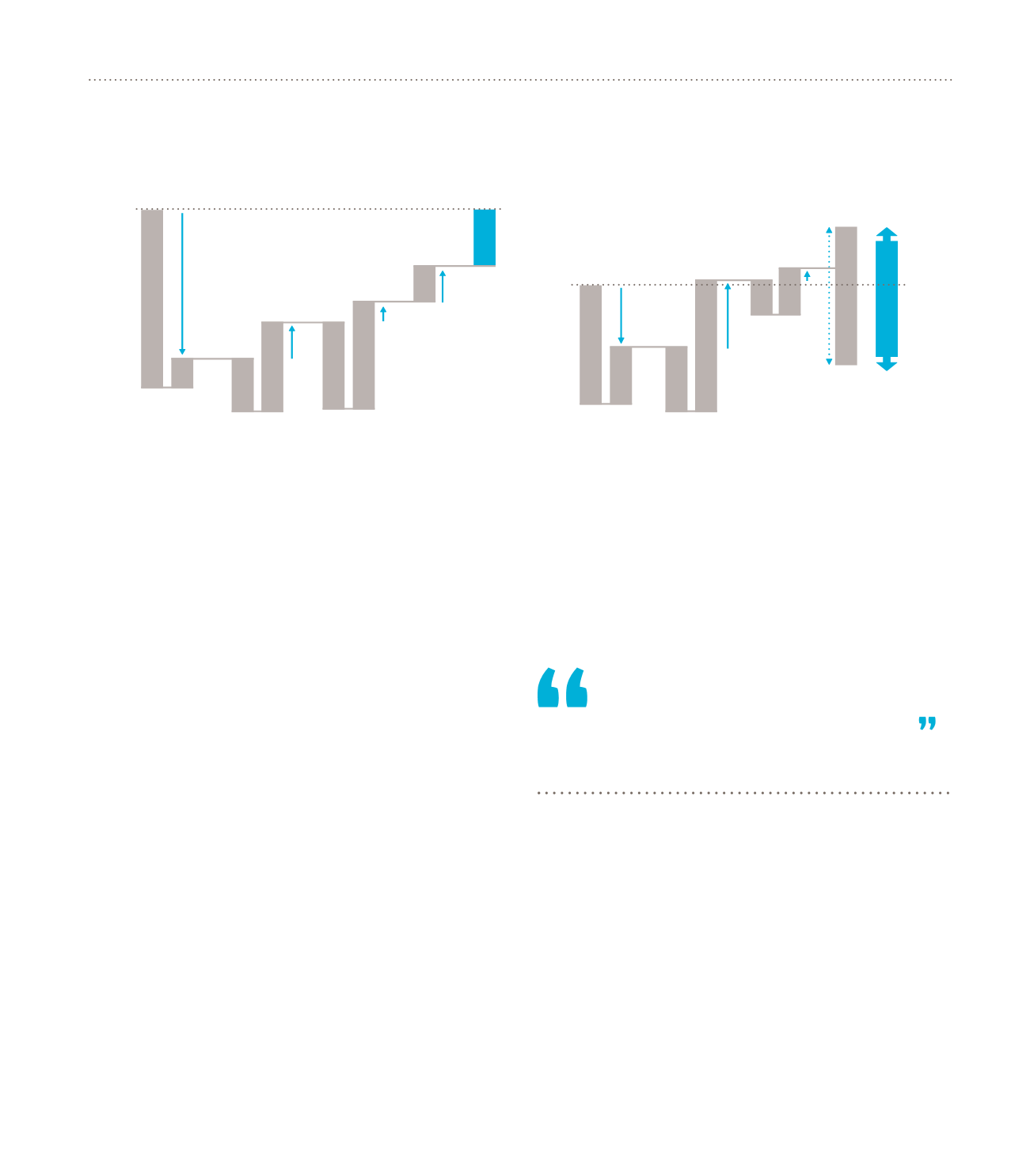

Operating

costs

decline $4.6 trillion

Depreciation &

amortization

increase by

$1.1 trillion

Financing

costs

increase by

$0.6 trillion

Net impact

$1.8 trillion in increased

nancial system capacity

Impact of

stranded assets

total $1.1 trillion

-1

-2

-3

-4

Fossil

Low-

Carbon

Fossil

Low-

Carbon

Fossil

Low-

Carbon

Fossil

-5

-6

-$7trn

Impact of stranded assets

ranges from $4.2 trillion bene t

to $1.8 trillion value loss

Financing

costs

increase by

$0.5 trillion

Depreciation &

amortization

increase by

$3 trillion

Operating

costs

decline

$2.8 trillion

Net impact

ranges form $2.5 trillion

cost to $3.5 trillion bene t

depending on policy

0

1

2

-1

-2

-3

-4

-5

-6

$3trn

Fossil

Low-

Carbon

Fossil

Fossil

Low-

Carbon

Fossil

Low-

Carbon